Amazon just announced its largest layoffs in company history; 30,000 corporate jobs while simultaneously pouring billions into AI infrastructure. CEO Andy Jassy isn't hiding the connection: he's publicly stated that AI efficiency gains mean they "will need fewer people doing some of the jobs that are being done today.". However, this isn't the confident march toward an AI future the press releases describe. It looks a lot more like panic.

Obligatory AI-gen photo:

The Numbers Don't Add Up

The central contradiction should worry any tech leader watching this unfold today. Amazon is spending billions on new data centers across multiple states to support AI infrastructure, yet at the same time they're cutting a reported 30,000 jobs. This is all on top of the 27,000 they already eliminated in 2022 and 2023, so that's nearly 60,000 people in three years. The official narrative? AI is making us so efficient we don't need these roles anymore. I don't buy it.

The reality? Well, Morgan Stanley is warning that AI hyperscalers' free cash flow growth has "turned decidedly negative," with projections showing it could shrink by 16% over the next 12 months.

Translation: They're firing people to pay for AI that might work.

When Hardware Becomes a Liability

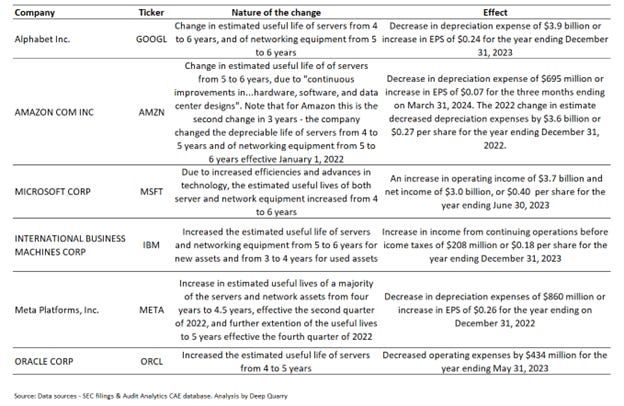

This is where the story gets really telling. At the start of 2024, Amazon made an accounting change that boosted their operating income by a massive $3.2 billion. They did this by increasing the useful life of their servers from five to six years, effectively telling investors their hardware was more valuable and durable than previously thought. Then, by the end of that same year, the AI arms race forced a dramatic and costly reversal.

According to their 10-K filing, the "increased pace of technology development" in AI forced them to admit their new, expensive hardware was becoming obsolete faster than they'd planned. This whiplash is now costing them a fortune: $0.92 billion accelerated depreciation (from Q4 2024) + decrease in 2025 operating income $0.7 billion (from 2025) + $0.6 billion continued accelerated depreciation (from 2025) that's $2.2 billion write-down spread across late 2024 and 2025. Let's connect this to the layoffs. The $1.3 billion hardware write-down they're taking in 2025 alone will consume over 17% of the estimated $7.5 billion they're saving from firing 30,000 people. This isn't just waste on an industrial scale, it's evidence of a massive strategic miscalculation. They are firing people, in part, to pay for a future they fundamentally misread just a few months ago.

Amazon's not alone here:

The Goldman Sachs Reality Check

When the CEO of Goldman Sachs starts comparing your industry to the dot-com bubble, it might be worth listening. He's warning that "a lot of this capital won't deliver returns" and predicting a "drawdown" in equity markets.

That's not just an opinion; it's a risk assessment from the top of the financial world. It reminds me of patterns I've seen before, just at a smaller scale. During my time working in hyper-growth companies I watched teams make the same mistake: big spending just to capture a share of a possible unquantifiable market is not a strategy.

I'm not saying Amazon's infrastructure investments are entirely wasted. Building AI capacity ahead of demand can be smart positioning, if you can afford it and have clear use cases. The railroad analogy that some defenders use isn't wrong: massive infrastructure often precedes the applications that justify it. The difference is that when a startup panic spends on infrastructure they don't need, they burn through their Series A and shut down. When Amazon does it, they fire 30,000 people and call it "transformation." When fear of missing out drives the roadmap, you get reactive, poorly planned decisions that only look strategic on a slide deck.

The Real AI Strategy Question

Which brings me to the question every tech leader should be asking: If AI is delivering on its promise, why is cash flow going down?

I think the answer points to a fundamental flaw in strategy. They're not investing based on demonstrated ROI or clear use cases. They're investing based on fear. Fear of an unsteady market, fear that competitors will gain an advantage, fear that they'll miss the next platform shift, fear that Wall Street will punish them for not being "AI-first." Some will argue this is just normal capital-intensive platform transition spending and that returns come later, after the infrastructure is built. Sure this might be correct, but when you're firing tens of thousands of people to fund that speculation, the human cost of being wrong becomes unacceptable.

What This Means for the Rest of Us

If you're a technology leader watching Amazon's moves and wondering what lessons to extract, here's perhaps a few to think about:

Don't confuse infrastructure spending with business value. Amazon is building massive AI capacity, but there's no evidence it's translating to proportional business outcomes. The efficiency gains they're claiming don't match the financial reality. What compounds this is that out of the big three clouds Amazon is arguably much further behind GCP and Azure and playing catchup.

Question the narrative. When a company fires 30,000 people while spending billions on speculative technology, there's probably something else going on besides the headline.

Humans don't forget. These aren't just numbers on a spreadsheet. These are experienced professionals, many of whom built the systems that made Amazon's current AI investments even possible. It may look like right-sizing but the insitutional damage from this will last much longer in the mind of what's always been a very fluid job market. Programming transformer based LLM systems, or whatever comes next, isn't exactly Comp-Sci 101; you do need bright minds.

The Uncomfortable Truth

Amazon's AI gamble represents an unfortunte trend of another giant who went too far too fast pushing innovation. Instead of measured iterative investment based on demonstrated value, we're seeing panic spending funded by human capital. The most damaging part isn't the financial waste, though that's substantial. It's the precedent this sets for the entire industry. When the most successful tech company in history starts firing people to fund speculation every other company feels pressure to follow suit. This is what happens when fear drives strategy and Wall Street expectations override operational reality.

The real test won't be whether Amazon's AI infrastructure delivers the promised efficiency gains, I'd imagine it will, despite this rather abrupt "right-sizing" event. It will be whether the industry learns to distinguish between genuine innovation and expensive panic before more companies follow this playbook. Because if this is what "AI transformation" looks like, we're transforming in the wrong direction.